Emerging Markets Investing: Middle East and Africa

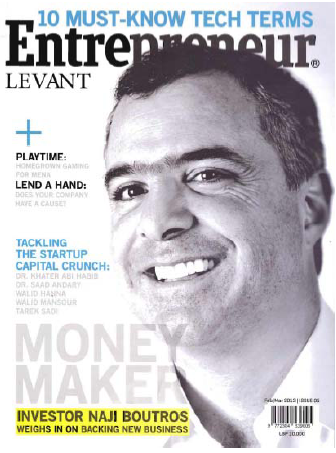

Presented by Naji Boutros, Chairman & CEO, Telegraph Capital Partners

Please save your spot and REGISTER here.

Bio:

Background:

- 30 years investment experience

- Chairman and CEO of various investment vehicles (Edge and Telegraph) (2011-todate)

- Principal, Member of Global Investment Committee and regional MENA head at Colony Capital (2003-2010)

- Senior investment banker at Bank of America Merrill Lynch real estate, hospitality, and leisure (1988-2000)

- Masters in Management Science and Engineering from Stanford University (1988)

- B.S. Electrical Engineering and Computer Science from the University of Notre Dame (Summa Cum Laude)

- Speaks English, French and Arabic

Experience:

- Investor with various partners in Europe, MENA & Turkey. Roles encompassed providing leadership, strategic planning, regional capital formation, identification, evaluation, consummation and management of investments. Notable transactions and roles include:

- Turkmall: Vice Chairman of a Turkish shopping center development and management company (Turkmall).

- La Tour Reseau de Soins: Chairman of the board of a mainly Swiss based health care concern.

- Net Logistics: Board member of a freight forwarding, express mail and logistics company.

- Mars Entertainment Group: Board member of Turkey’s largest entertainment and cinema company.

- Cortas Food: Chairman of the board of the holding company of this global leader of mediterranean cuisine.

- Ayyam Gallery: Investor and Board member in a chain of contemporary and modern art galleries.

- Chateau Belle-Vue: Family owned winery, vineyards, and hospitality endeavor.

- Partner and Member of Colony Capital’s global investment committee. Active participant in screening and in making substantial investments in operating businesses with underlying real estate. Notable transactions and roles include:

- Leisure and entertainment companies such as Mars Entertainment Group

- Retail Chains such as Carrefour

- Hospitality chains such as Accor, Raffles, and Fairmont

- Gaming and casino chains such as Group Lucien Barriere, Kerzner, Hilton Vegas, Station casinos etc.

- Bank of America Merrill Lynch Investment Banking: Joined in New York at the height of the REIT activity. Transferred to the London office where I led the European and MENA Real Estate Leisure and Lodging Investment Banking activity. This was undoutbtedly the busiest time in property advisory and corporate finance. Our Group led the REIT IPOs at the time. Notable transactions include:

- Advisory: First Advisory Capacity to French government owned “bad bank”, CDR Immobilier, a Credit Lyonnais offshoot. Other mandates such as Ladbroke in its purchase of Hilton. Bass in its purchase of Holiday Inn. Colony in its purchase of Savoy.

- Public Equity: Largest Market Share in floating Real Estate Companies (over US$50 billion). We also did the First GDR offering for a leading Emerging Markets Real Estate Development Company.

- Private Equity: Launched and Advised several US and European Private Equity funds. Notable transaction include launching the first blind pool Continental European fund (Crossroad Property Investors) and UK based Private Equity funds (Pacific Investments). Several billions were raised and I ended up joining one of the funds as a Partner.

- Member of the Investment Committee of a World Bank subsidiary which invests in small and medium size technology companies in Emerging Markets.